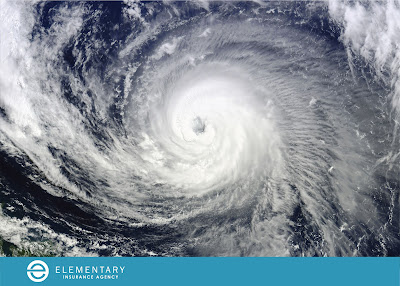

Hurricane Season 2021

Hurricane season is typically June through November. Hurricanes at a category one or two aren’t severe. But, for hurricanes that reach category four or five, these can be catastrophic and sometimes fatal. If you own property along the eastern seaboard, you know that this can mean potential damage to your home. Now is the time to revisit and familiarize yourself with your current insurance plan and coverage options before extreme weather conditions happen, so you can best protect your home and assets. Before we discuss insurance advice, let us go over some hurricane season tips.

Tips For Hurricane Season

Before |

Talk with your family about what to do if a hurricane strikes. Discussing hurricanes ahead of time helps reduce fear, particularly for younger children

NOAA Radio Stations are a great way to informed

Protect windows with permanent storm shutters or invest in one-half inch marine plywood that is pre-cut to fit your doors and windows.

Identify a place to store lawn furniture, toys, gardening tools and trash cans (away from stairs and exits) to prevent them from being moved by high winds and possibly hurting someone.

Clear loose and clogged rain gutters and downspouts to prevent flooding and unnecessary pressure on the awnings.

During |

Stay indoors.

Don’t walk on beaches, riverbanks or in flood waters.

Use flashlights in the dark if the power goes out. Do NOT use candles.

Avoid contact with floodwater. It may be contaminated with sewage or contain dangerous insects or animals.

Keep listening to NOAA Radio Stations

Turn off the power and water mains if instructed to do so by local authorities.

If caught on a flooded road with rapidly rising waters, get out of the car quickly and move to higher ground.

After |

Let friends and family know you’re safe - Register yourself as safe on the Safe and Well website

If evacuated, return only when authorities say it is safe to do so.

Continue listening to local news or a NOAA Weather Radio for updated information and instructions.

Stay alert for extended rainfall and subsequent flooding.

Flood Insurance and Water Coverage

If you are at risk for water damage and perhaps located in a high-risk flood zone then water coverage and flood insurance could be a consideration. Elementary offers Flood insurance through great carriers and can focus on the appropriate coverage for water risks. The damage from a flood is not covered under a standard homeowner's policy. Flood insurance is a special policy that is federally backed by the National Flood Insurance Program (NFIP) and available for homeowners, renters and businesses.

Call us for a Quote

Elementary is focused on helping you increase your savings, raising your deductible, providing you with discounts and applying credit as much as possible. Learn more about Elementary homeowners insurance products, or if you’re ready to take the next step, call (813) 212-8505 for a FREE no obligation quote.

Comments

Post a Comment