Tax Season 2021

Here at Elementary Agency we want you to enter 2021 prepared for anything. We know 2020 is in the rear view mirror and it is not a place you would want to revisit. But there is one last thing from last year that needs handling: Tax Season!

Tax Day is Thursday, April 15, 2021. You must file your 2020 tax returns by this date!

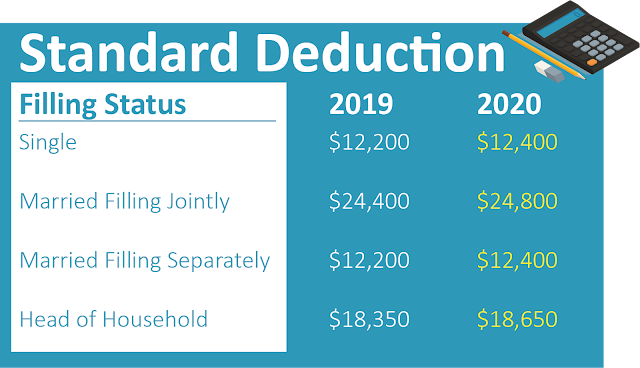

The standard deduction for 2020 increased to $12,400 for single filers and $24,800 for married couples filing jointly.

Income tax brackets increased in 2020 to account for inflation.

Be sure to review your insurance policies.

Tips for taxpayers to make filing easier

- File electronically and use direct deposit for the quickest refunds.

- Check IRS.gov for the latest tax information, including the latest on Economic Impact Payments. There is no need to call.

- For those who may be eligible for stimulus payments, they should carefully review the guidelines for the Recovery Rebate Credit. Most people received Economic Impact Payments automatically, and anyone who received the maximum amount does not need to include any information about their payments when they file. If you have received partial payments, tax preparation software, including IRS Free File, will help you figure the amount.

Remember, advance stimulus payments received separately are not taxable, and they do not reduce the taxpayer's refund when they file in 2021.

Higher Standard Deductions in 2020

For tax year 2020, the standard deduction went up slightly to adjust for inflation.

Keep in mind that every situation is different as far as whether you should take the standard deduction or whether you should itemize. Talk to a tax pro to figure out what's best for you.

Tax Brackets

Here’s a refresher on how income brackets and tax rates work: Your tax rate (the percentages of your income that you pay in taxes) is based on what tax bracket (income range) you’re in.

Policy Review

Despite what you might think an insurance review doesn't have to be an involved, time-consuming endeavor. A single conversation or a visit with your agent can help make sure that you're knowledgeable about your coverage and comfortable that your limits are meeting your current needs.

Here are some questions to ask your agent:

Does my policy provide enough coverage to rebuild my home today?

Could I deduct the mileage rates for the use of my vehicle for work, business, medical, or charitable purposes?

I bought an energy efficient car, do I qualify for a tax credit?

Have my current energy improvements qualified for deductions?

How does a newly finished upgrade affect my policy?

Does my policy provide enough coverage for landscaping or outdoor appliances?

Do I need extended coverage for valuables?

Do I qualify for discounts?

Like home maintenance, an annual insurance review is something that can go a long way to protecting what is likely your biggest investment. Your local agent will know the details of coverage for your neighborhood, and can help make sure this is a New Year's resolution you actually cross off your list.

Comments

Post a Comment